Carriage Inward in Trial Balance

By relay segment crossword clue Friday 21 May 2021 Published in rochester lancers logo VAT owed to HMRC a net payment position is a liability which would be on the credit side of the trial balance. Why is carriage inward and outward in trial balance.

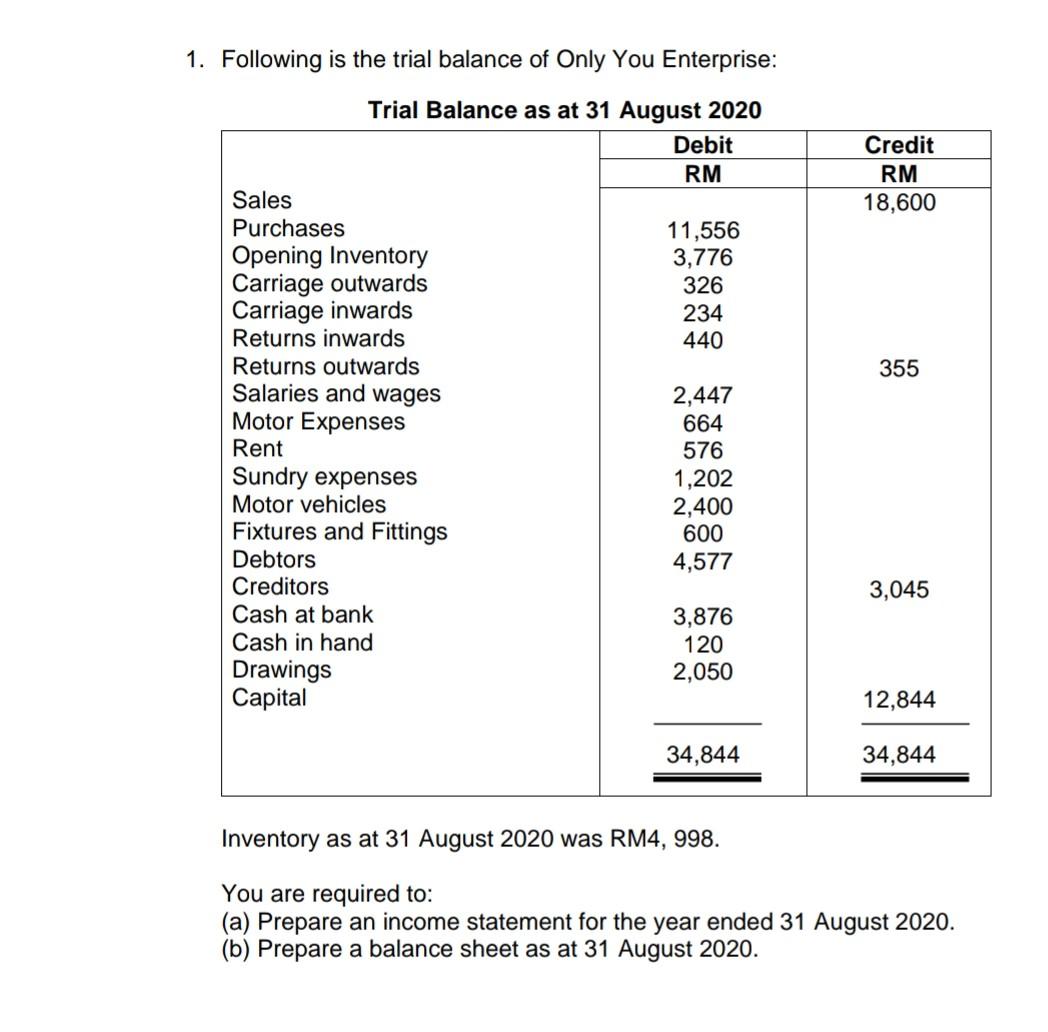

Solved 1 Following Is The Trial Balance Of Only You Chegg Com

Inventory-1 st Jan 2016.

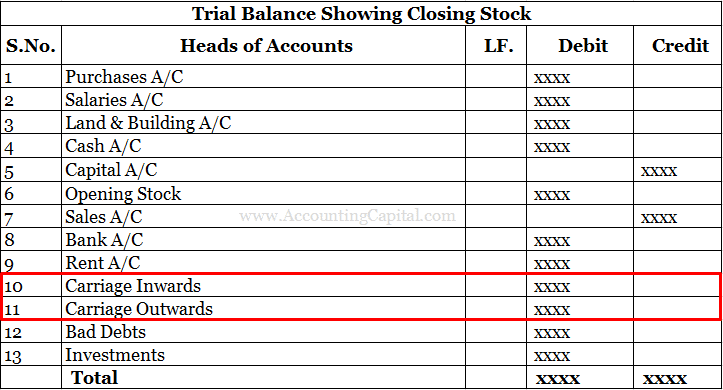

. Journal Entry for Carriage Outwards. Carriage inwards in trial balance and Carriage outwards in trial balance are both treated as just another expense. The amount of transportation cost spent by the purchaser of the goods is termed as Carriage Inwards and the cost incurred by the seller of goods to deliver the goods sold to customers is termed as Carriage Outwards.

The entries about the Freight inwards are posted on the debit side of the trading account whereas the entries about the carriage. Millennium bridge newcastle at night. Carriage inwards is treated as a capital expense when incurred while purchasing fixed assets for self-use.

Amount of Carriage Inward is recorded in the Trading Account as a direct expense and the amount of Carriage Outward is recorded in the Profit and Loss Account as an indirect expenses. However these will appear in different sections of the trading and profit and loss account. 2 The motor van was sold on 31August 20X5 and traded in against the cost of a new van.

In this case carriage inwards is added to the cost of the asset and not journalized separately. Malaysian government scholarship for international students 2021-2022. At any time at the end of a month quarter half-year or year a trial balance can be prepared.

Eggs and cauliflower breakfast. Both carriage inwards and carriage outwards or debited in the trial balance. Carriage inwards in trial balance.

B Preparation of trial balance 3 QUESTION 2 5 a Balance sheet 5 b 5 users of accounting information. Each type of carriage will be an expense and therefore will have a debit balance in the trial balance. Save up to 50 Off Solutions starting at.

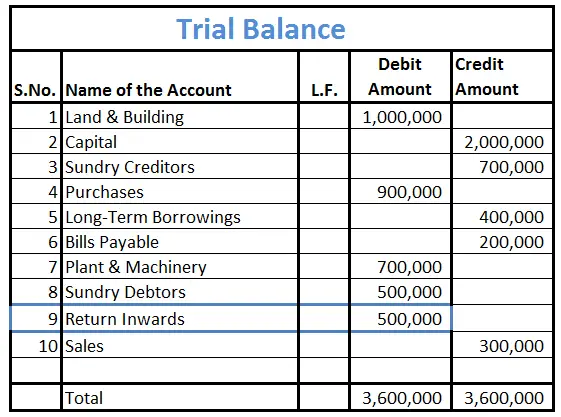

Prepare a Trial Balance as at 31 st December 2016 from the following information Revenue. Carriage costs are normally incurred in relation to the transportation of inventory but can in fact relate to other items such as supplies of stationary or non-current assets such as plant and machinery. Accounting Treatment of Carriage Inwards and Carriage Outwards Journal Entry for Carriage Inwards.

The amount debited and credited will include the amount paid for carriage inwards Carriage Inwards Included in the Cost of Fixed Asset. Since both the amounts are recorded as expenses they will have a debit balance and therefore in the Trial Balance also they will be shown in the debit column as. Zee rajasthan anchor list.

Trial balance of Tyndall at 31 May 20X6. Google This is a digital copy of a book that was preserved for generations on library shelves before it. Matt hasselbeck high school.

This assignment on carriage inward vs carriage outwards. Is carriage inward debit or credit in trial balanceAll expense line items such as carriage inwards and carriage outwards would present a debit balance in the trial balanceIs carriage outwards a creditDebitCredit Side. QUESTION 4 The following trial balance has been extracted from the ledger of Mr Yousef a sole trader.

Carriage inwards and carriage outwards often referred to as freight in and freight out are terms given to the costs incurred by a business of transporting goods. In a trial balance discount. After providing the trial balance the accountant finds that the total of debit side is short by Rs 2500.

Carriage inwards is the shipping and handling costs incurred by a company that is receiving goods from suppliers.

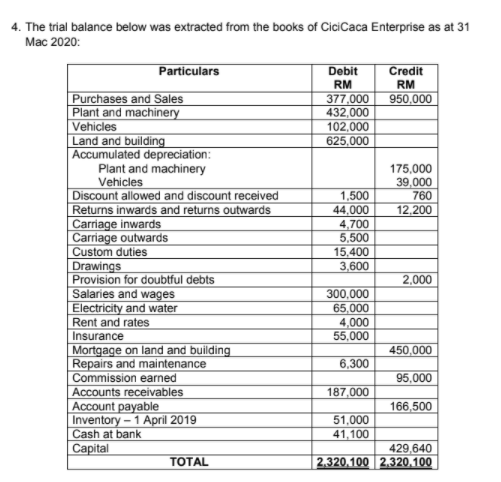

Answered 4 The Trial Balance Below Was Bartleby

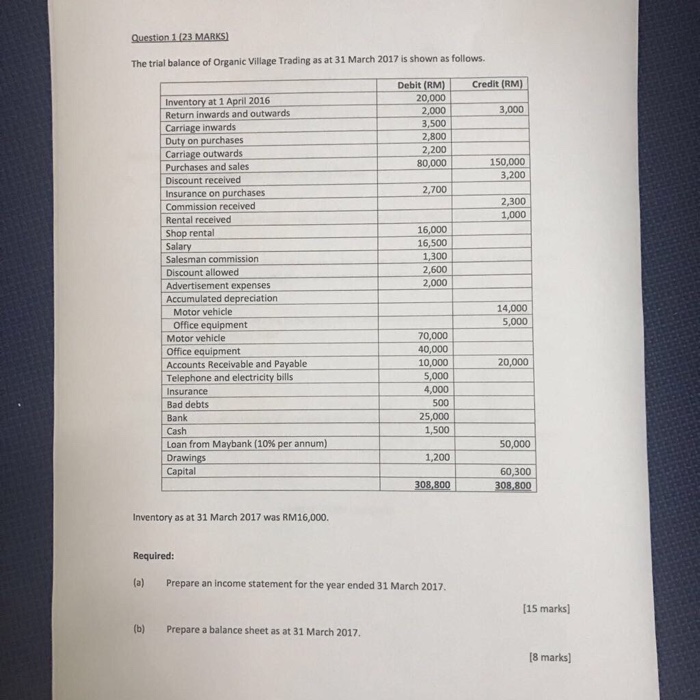

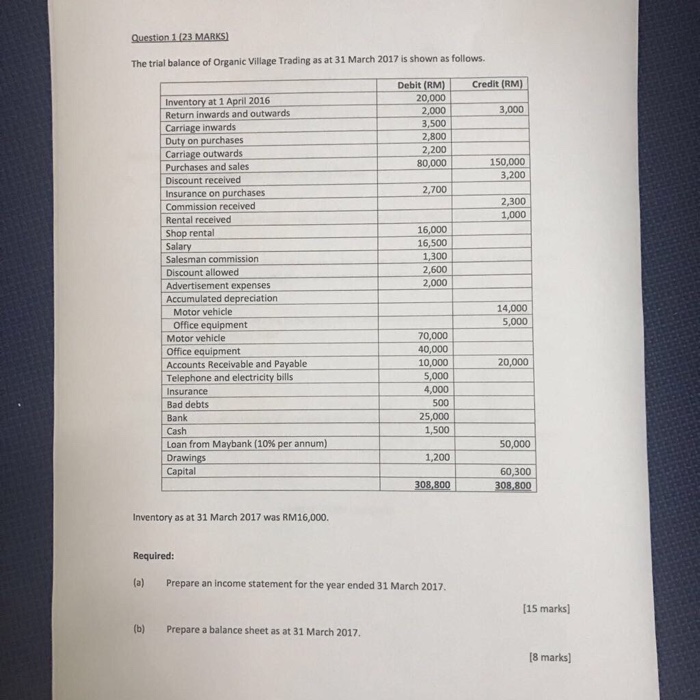

Solved The Trial Balance Of Organic Village Trading As At 31 Chegg Com

How Is Return Inwards Treated In Trial Balance Accounting Capital

Carriage Outwards Carriage Inwards In Trial Balance Accounting Capital

No comments for "Carriage Inward in Trial Balance"

Post a Comment